High Return Stocks

Finding Tomorrow’s Winners Today using charts, screeners and other various trading enablement tools.

recent posts

- Oracle ($ORCL) — Why This Pullback Could Be a Good Buy Opportunity

- ($CLPS): Profitable Growth, Global Hiring, and AI-Powered Modernization

- Will be posting again in a week or two

- MannKind ($MNKD): Analyst Targets Are Rising — Should you wait for things to cool off?

- MongoDB ($MDB): A Compelling Growth Opportunity

Category: Uncategorized

-

I am buying into $ORCL this morning in the $188 range for a long swing going into 2026. Many analyst have it in the mid $300’s on their targets indicating we are trading at a very discounted rate on the big drop today. They saw an EPS beat and strong cloud/AI growth which I believe…

-

In the crowded world of fintech and IT services, most small-cap companies struggle to differentiate themselves. CLPS Incorporation (NASDAQ: CLPS) is starting to stand out. Between its profitable earnings this year, aggressive global hiring, and a landmark AI-powered banking modernization project, CLPS is signaling that it’s positioned for growth in one of the most important…

-

Hi Everyone, sorry for no new blogs the past week. We had water damage to our home and have been dealing with insurance, contractors, remediators, etc with not a lot of time to make new posts. That being said a lot of small cap companies seem to be emerging and look to be good plays…

-

MannKind Corp. (NASDAQ: MNKD) just experienced a major surge, with shares jumping more than 20% intraday on heavy volume. The rally has been fueled by a wave of analyst upgrades, positive trial data, and new strategic moves that could set the stage for long-term growth. But with the stock technically overbought in the short term…

-

MongoDB is gaining renewed investor interest. The recent quarter revealed big cloud growth and upgraded guidance, while AI momentum continues to show future upside. They also added 2,600 new customers in Q1 an all time record in customer growth, showing their product and sales outreach is working. Average analyst price targets also show over 30%…

-

After a lengthy pull back, shares of Nike are finally starting to stabilize and for the first time in months, the technical picture is showing constructive signs. Especially looking at the moving averages and how $KNE is sitting above the 20, 50 and 200 day moving averages. $NKE also has an dividend date of Aug…

-

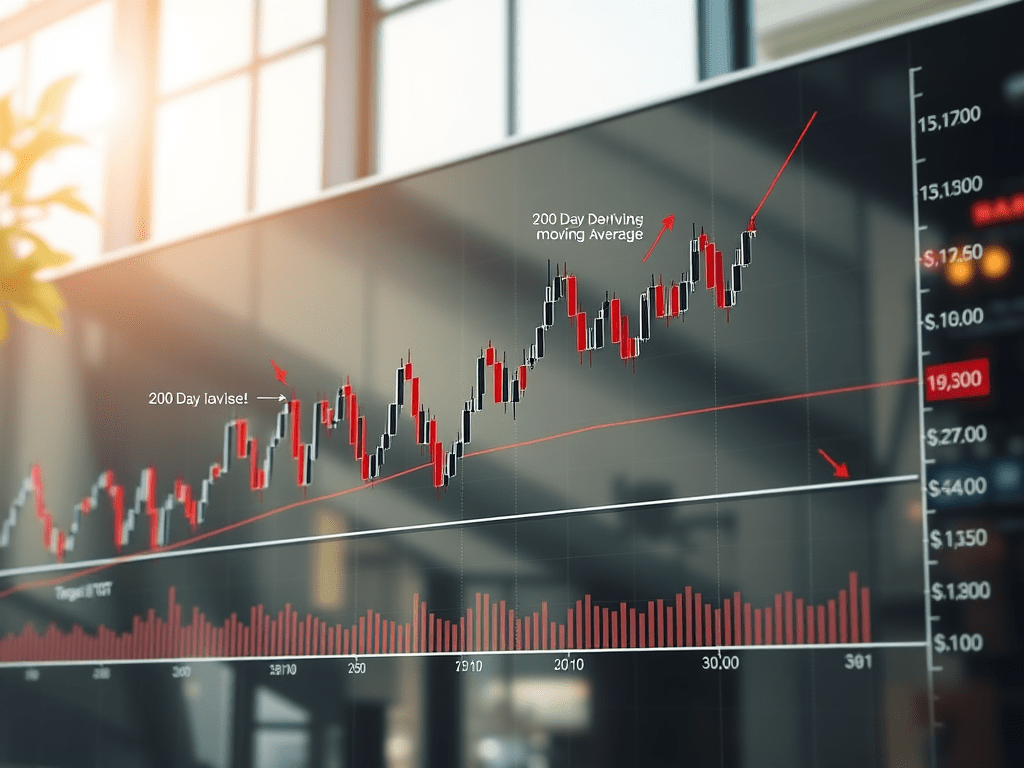

$TGT is beginning to look attractive at current levels, with prices recently bouncing off 200 month moving average, shows there is a good support level that has formed. Trading much lower than counterparts like Walmart $WMT. I’ve added $TGT to my watchlist, Target is attractive on valuation and income metrics, it is currently trading well…

-

Hi Everyone, I hope you all are enjoying these posts. I was going to make this blog yesterday, but was too busy. Seems like Intel is already doing great today. I am keeping it on watch for a slight pullback from today’s hype as a future swing. Here is why, Intel is attracting serious institutional…

-

I believe $NVO is starting to bottom out. With nearly $67.5B in assets, $18.9B in cash, and a healthy 59% debt-to-equity ratio, it’s in a prime position to weather market swings and invest in future expansion. The company’s 3.2% dividend yield, coupled with a historically low P/E of around 12.9×, offers both income and potential…

-

$APWC is another one of my top holds I have been accumulated this year. With earnings today coming out very positive and turning a net loss into a profit QoQ, this could be the next 100%-200% runner once volume comes pouring in. APWC also has a history of running very hard, for example in 2021…