$TGT is beginning to look attractive at current levels, with prices recently bouncing off 200 month moving average, shows there is a good support level that has formed. Trading much lower than counterparts like Walmart $WMT. I’ve added $TGT to my watchlist, Target is attractive on valuation and income metrics, it is currently trading well below fair values suggested by both peer P/E and Morningstar modeling, and offering a stout 4.5% dividend yield. With Earnings bringing this much lower today, now may be a great time to start a position.

Fundamentals & Value Proposition

- Undervalued Compared to Peers: Target trades at a forward P/E of approximately 12.4×, substantially lower than peers such as Dollar General (~18×), Dollar Tree (~17×), and Costco (~51×) — suggesting potential value if fundamentals stabilize. fool.com+4nasdaq.com+4stockinvest.us+4

- Undervalued on Morningstar Measures: Assigned a 4-star rating with a long-term fair value estimate near $123. morningstar.com

- Dividend Appeal: Recent articles highlight a near-record 4.5% dividend yield, offering income support during the recovery. fool.com

Near-Term Headwinds & Retail Footprints

- Tariff Pressure & Cost Exposure: Roughly 50% of Target’s cost of goods sold comes from imports — much higher than Walmart (~33%) — meaning volatility from tariffs could force price increases of up to 8%, nearly double Walmart’s impact. marketwatch.com+1

- Eroding Digital Traction: Mobile app usage dropped 14% in July, whereas Walmart’s surged 17% — signaling weak momentum in Target’s digital and marketplace strategy. barrons.com+2marketwatch.com+2

- Retail Foot Traffic and Brand Loyalty Decline: In-store experience issues, rollback of DEI policies, and customer dissatisfaction have combined to drive traffic down and erode brand perception. morningstar.com+7businessinsider.com+7apnews.com+7

- Retail Partnership Disruption: The end of its Ulta Beauty “shop-in-shop” features (600+ locations by 2026) removes a premium beauty draw that had supported Target’s discretionary success. fool.com+4the-sun.com+4marketwatch.com+4

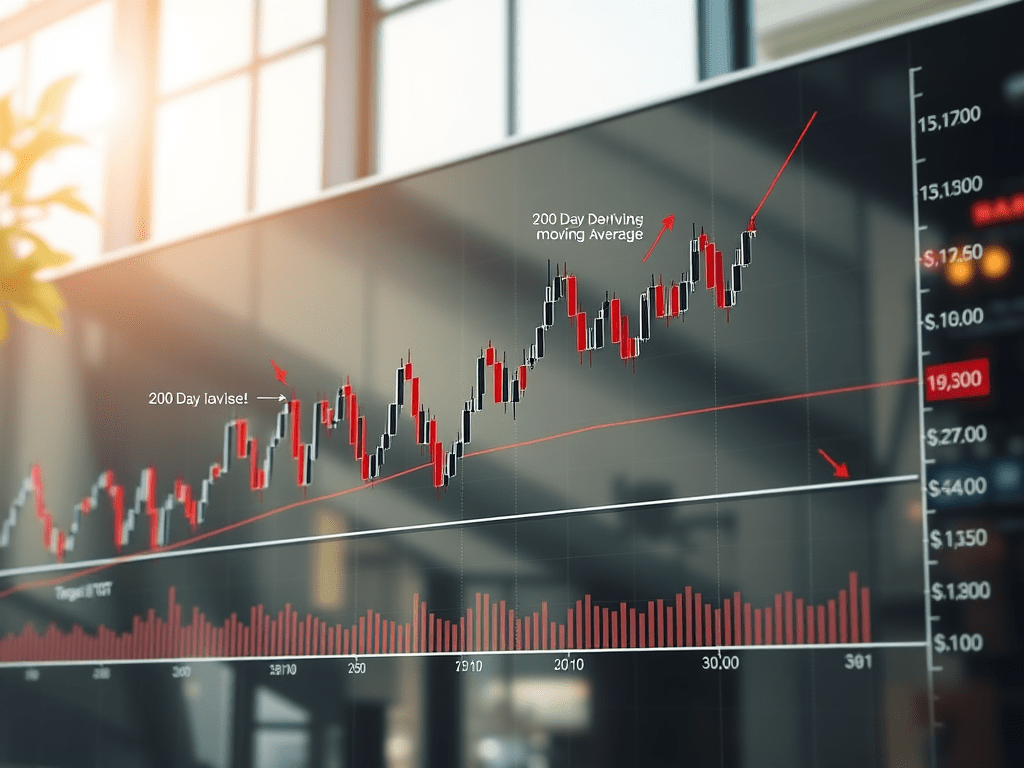

Technical Overview

- Positive Technical Setup: Target shows buy signals from both short- and long-term moving averages, and the MACD indicator is also signaling upward momentum. Support levels appear around $104–$105, while risk lies if these are lost. stockinvest.us+2nasdaq.com+2

Summary

Target is attractive on valuation and income metrics — currently trading well below fair values suggested by both peer P/E and Morningstar modeling, and offering a stout 4.5% dividend yield. However, near-term risks are significant: increased tariff burden, weakening digital engagement, declining in-store experience, and the termination of its Ulta partnership all weigh on the turnaround narrative. While technicals hint at a potential stabilization, meaningful recovery will likely depend on strategic leadership, digital revitalization, and execution on cost efficiencies.

Leave a comment